When do you need Letters Testamentary?

You typically need Letters Testamentary to prove that you have authority to act on

behalf of an estate. Typically this happens when the heirs or named executor are attempting to

act or claim assets on behalf of the estate.

First, a short story which may sound familiar....

Henry Husband has died leaving bank accounts in his name that do not have a designated beneficiary. Fortunately, Henry was a responsible adult and he took the time to plan his estate by executing a Last Will and Testament. The Will names his wife to serve as independent executor and was signed, witnessed, and notarized. The Will was on cotton paper and came in a fancy binder with the lawyer's cover letter stating that the Will was valid and properly executed. The Will could not look more official and legal.

Wilma Wife takes the binder to the bank to claim the account. The banker takes a look at the Will and then goes to her branch manager's office. The banker comes back and asks, "Do you have Letters Testamentary?" Wilma says "no", but points to the Will where it says she is the sole heir and the executor of the estate. The banker apologetically (sometimes) delivers the bad news: The bank cannot give the funds in the account to Wilma until she gets Letters Testamentary. Wilma will need to get a "Letter" from a judge. Furthermore, now that the bank knows Henry is deceased, the bank is freezing the account.

The situation described above happens all the time. Though it might sound ridiculous, there are good reasons why Letters Testamentary are requested by the bank. First of all, the banker has no way of knowing whether the Will that is being presented is indeed the LAST Will. What if the decedent executed a later will completely changing his or her estate plan? What if the Will is a fraud, a forgery, or procured when the decedent did not have capacity? What if Henry and Wilma divorced after the date the Will was executed? What if Henry had a child after executing the Will? What if Wilma is not qualified to serve as executor? The point is the bank is not in a position to answer these questions whereas a court can be.

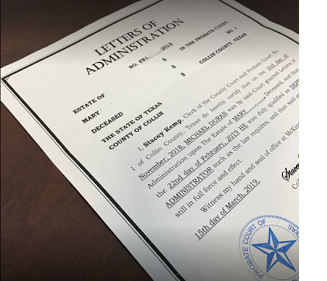

The law has evolved to protect both the heirs of the estate and the financial institutions and entities that are holding the property of the estate. Texas law provides that in order to get Letters Testamentary, the executor must swear under oath to the judge that none of the above issues are present. The court can then issue Letters Testamentary to the executor who is then responsible for the assets of the estate. A person or entity that delivers property to the court-appointed executor is protected against liability if thereafter the property goes missing. That is why they insist on receiving Letters Testamentary.

What can you do to avoid your heirs having to get Letters Testamentary?

You may be thinking to yourself, "What a goat rope! I hope that my heirs do not have to go through this." There is a simple way to avoid this: PUT A "P.O.D." or "T.O.D." BENEFICIARY ON YOUR ACCOUNTS. Accounts with a named beneficiary can usually be claimed with only a death certificate. Letters Testamentary are not required because the account agreement with the bank says, "On my death, pay this account to ______________." Thus, to claim a "pay on death", "transfer on death", or "right of survivorship" account, one need only prove that the account holder is dead. That proof is accomplished with a death certificate.

What is the time limit on requesting Letters Testamentary?

The Texas estates code puts a time limit of four years from the date of death of the decedent, however, there is an exception. The court can issue Letters Testamentary if letters are required to collect an asset of the estate. Thus, after four years, the court will put a special emphasis on the "necessity of administration."

How long are Letters Testamentary valid?

Theoretically, the Letters Testamentary do not have an expiration date. If the estate has not been closed by the court, the Letters Testamentary remain valid indefinitely. Practically speaking, however, most financial institutions request Letters Testamentary that were issued by the court clerk within the last 90 days.

When are Letters Testamentary unnecessary?

See our "Alternatives" page to read about situations in which letters testamentary are not needed.

Office Location

Michael A. Duran

13355 Noel Rd Ste 1100 LB 20a

Dallas, TX 75240

USA

Company Details

Michael A. Duran

Probate Attorney