What are the alternatives to Letters Testamentary?

Though a financial institution may be demanding Letters Testamentary, they are not always required.

Upon attempting to claim the decedent's assets, financial institutions or other entities often insist upon receiving Letters Testamentary. Letters Testamentary are not always required. In many cases there are alternatives to getting Letters Testamentary.

Accounts with surviving named beneficaries can be claimed without Letters Testamentary. Texas law has evolved recently to encourage people to designate a beneficiary on their financial acconts. A beneficiary designation is a contract or agreement with the financial instritution. The contract provides that upon the death of the account holder, the ownership of the account will automatically pass to another person. If the account is held jointly, the account may be held jointly "with a right of survivorship." This is often abbreviated as "JTWROS."

It is not necessary to share your account before you die to have a beneficiary on the account. Instead, you can designate a "pay on death" or "transfer on death" beneficiary on the account. These are often abbreviated as "P.O.D." or "T.O.D." These beneficiary designations mean just what they say: upon the death of the account holder, the account will be paid or transferred to the designated beneficiary. Before rushing out to get Letters Testamentary, the heirs of the estate should confirm that the decedent's account did not have a beneficiary designation.

Are there alternatives to Letters Testamentary if there are not beneficiaries on the decedent's accounts?

IF THE DECEDENT DID NOT LEAVE A WILL, and the decedent's estate is valued at less than $75,000, then all of the heirs of the estate can join together and file a small estate affidavit with the probate court having jurisdiction over the decedent's estate. A small estate affidavit summarizes all of the facts about the estate. The small estate affidavit must then signed by ALL of the intestate heirs of the estate. The intestate heirs of the estate are all of the heirs who take under the law in the absence of a will. The small estate affidavit must also be signed by two disinterested witnesses who confirm that the facts alleged in the small estate affidavit are true. The small estate affidavit is then filed with the court. If the small estate affidavit is approved, the court will issue an Order Approving Small Estate Affidavit. A certified copy of the Small Estate Affidavit and the Order Approving Small Estate Affidavit can then be presented to the financial institution holding the decedent's account. A financial institution releasing funds to an heir pursuant to a small estate affidavit is released to the same degree as if the funds were released to an executor with Letters Testamentary.

Is there a way to collect an account without going through the courts?

For very small accounts, some financial institutions will sometimes release a small account to the heirs of the estate pursuant to an affidavit of heirship. An affidavit of heirship is very similar to a small estate affidavit, however, an affidavit of heirship is not filed with the probate court. Instead, the affidavit of heirship is signed by the heirs and disinterested witnesses, just like a small estate affidavit. It is then presented to the financial institution holding the account. The institution can then decide if it feels confident that there are not going to be any problems if the funds are released. For extra "oomph", the heirs of the estate may want to file the affidavit of heirship in the deed records of the local county clerk. Filing a fraudulent document with the county is a serious offense. Thus, the financial institution may more readily rely on the affidavit that bears the county clerk seal.

What if the bank refuses to release the account pursuant to an affidavit?

Ask the bank to pay the funds to the Texas Comptroller of Public Accounts Unclaimed Property Division. The Comtroller holds proceeds from dormant accounts. Claiming the funds from the Comptroller is often easier than claiming funds from a financial institution.

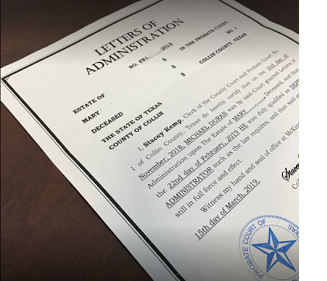

If all else fails, you must go to the court to get Letters. An executor named in a will can ask the court for Letters Testamentary. An heir of the estate can go to the court and ask the court to issue Letters of Administration. If all of the heirs agree, the court may also waive any bond requirement if not already waived in the Will. If all of the heirs agree, the court may also grant an indepedent administration, meaning that the court will not supervise the administration of the estate, other than to require a notice to creditors, and the return of an inventory, appraisement and list of claims to the court. Without the unanimous agreement from all of the heirs, that inexpensive probate referenced on the "Cost?" page go away. A dependent administrator must post a bond and must get court approval for just about everything he or she does prior to taking any significant action like, paying a bill, selling property, or distributing any funds from the estate, Because of the technical requirements of the Texas Estates Code, you will probably need an attorney to prepare the applications necessary to getting court approval in a dependent administration.

Office Location

Michael A. Duran

13355 Noel Rd Ste 1100 LB 20a

Dallas, TX 75240

USA

Company Details

Michael A. Duran

Probate Attorney